Introduction

The high cost of a top-end smartphone, whether paid up front or spread out over a 24 month contract, is causing many smartphone owners to turn to insurance to protect their investment. After all, it makes sense to spend a small amount of money to obviate a large amount of risk, right?

Well, sometimes. Even if you believe in the value of insurance it’s difficult to figure out which of the myriad plans available is the best for you. While you can have a look at insurance comparison websites, these can often be overly reductive and ignore many viable options.

In this article, we’ll examine the possibilities and help you figure out the option that works best for you.

No Insurance: No Monthly Cost, No Protection

It’s entirely possible that you can get by without phone insurance. If you’ve never lost or damaged a phone in years of owning one, you’ve purchased a good case for your phone, and you don’t travel into areas with high crime, then you might not need insurance at all.

This is especially true for pay-as-you-go customers, as losing your phone can only result in your remaining credit being used; it is impossible for further fraudulent charges to be applied.

For contract customers, this possibility can be one of the strongest reasons that you should invest in insurance of this kind; to make sure that hundreds of pounds of further charges can’t be accrued. If you do lose your phone and you don’t have insurance, contact your mobile operator immediately to prevent fraudulent use. You’ll still have to pay out the rest of your contract, but at least you can get your SIM card replaced fairly inexpensively (if not for free) to use in an old phone.

If you have lost phones before, even from accidental damage or theft, then you may be at greater risk for losing your phone in the future. In this case, you’ll probably want to examine one of the other options presented below. The same is true if you’re a contract customer, as you’ll want to avoid potential fraudulent use if someone finds or steals your phone.

Self Insurance: As Much Protection As You Put In

An unusual half-way house between no insurance and insurance is so-called “self insurance.” In this case, you can voluntarily put some money each month into a high interest savings account.

This self-imposed financial backup will allow you to ensure you can afford to buy a new phone if your original is lost or damaged, although of course you won’t be actually paying any more or less than if you had no insurance at all. If you don’t need to ‘claim’, then you can simply transfer the money and the interest back into your primary account.

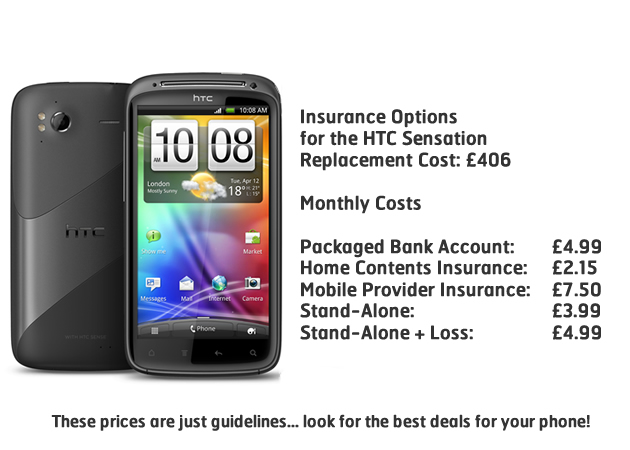

To determine how much you should set aside each month, have a look at the replacement costs, typically the cost of the phone. If you’re close to the end of your contract, it’s possible to negotiate a new phone by signing a new deal.

Home Contents Insurance: A Risky, Low Cost Option You Might Already Have

A tempting insurance option is to cover your mobile phone using your existing home contents insurance. Your mobile phone may already be covered, so if you have home contents insurance you should check to see if this is the case. If your smartphone isn’t covered by your policy, then you may be able to add it by paying an additional premium, increasing the total price by perhaps £25 per year.

This sounds like a pretty good deal, but there is one major drawback: If you do lose your phone and claim it on insurance, then you lose your no-claims discount for the entire account. This means that you will likely lose more than the claim is worth on future rate increases, making this a tenuous option.

Another problem is that the cost of the phone may not be entirely covered, as you will likely have to pay an excess. Hopefully this will be a small amount (less than £30) but higher amounts are quite possible. It’s also likely that you will not be able to have your phone replaced as quickly as more specialised services, which we will cover later. Finally, your phone might be replaced, or you might have its cash value returned — but beware, this can be the retail price, market price, or price of network replacement.

Packaged Bank Accounts: A Low Cost Alternative You Might Already Have

Another type of insurance that you may already have comes from your packaged bank account. Usually this mobile phone protection is one the major selling points of a packaged bank account, but it’s worth checking your current account just to make sure – you don’t want to be paying for mobile phone insurance twice.

Otherwise, packaged bank accounts can be a good option, but it’s always important to read the small print and make sure the excess is not excessive and the terms are favourable.

Mobile Provider Insurance: Well Suited, But Can Be Expensive

Another popular insurance option is to receive insurance from your mobile provider themselves. All of the major operators (T-Mobile, Orange, O2, Vodafone and 3) offer insurance, so have a look at your network provider’s offerings on their official website.

If you’re on one of the many virtual operators, it’s more of a mixed bag – giffgaff and Tesco Mobile both use O2’s networks, but giffgaff don’t offer insurance.

If your provider does offer insurance, then it can often be a fairly good deal, and you can be assured that the replacement that you receive will work well on their networks. These deals often have good replacement time frames as well, typically offering replacement with 24 to 48 hours.

Still, there can be better options available – as with any insurance policy, calculate the excess and the monthly price to figure out how much you would save by replacing your phone after a year of payments. Also, be sure that you register the phone properly, giving serial and IMEI numbers where appropriate – you really don’t want to find out later that you didn’t get around to it.

Stand-Alone Insurance: Competitive Prices, Customised Protection

The final and usually most competitive option is that of specialised mobile phone insurance. This insurance is typically quite good value, offering extra coverage such as worldwide theft, breakdown, liquid and accidental damage.

The amount you pay each month can depend on the phone that you own, so if you have a particularly expensive or cheap phone then it can be advantageous to spend some time shopping around to get the best policy; expensive phones can be covered under cover-all rates, where as cheaper phones could be best insured on sites that base the monthly cost on the model of the phone. Generally the iPhone can be the most expensive phone to get insured, so you’ll want to find an insurer that doesn’t force you to pay an extra premium.

Another benefit of stand-alone insurance is that you can typically add additional mobile phones to the same plan relatively inexpensively, making getting your entire family insured quite convenient.

Overall, this can be the best option if you’re not already covered by your bank or mobile operator.

Conclusion (TL; DR)

There are quite a few insurance options available, but hopefully this article will have gone some way towards simplifying the matter at hand. The key advice is this:

- Don’t get insurance if you don’t need it — if you don’t lose phones as a rule, then you’ll probably spend more money on insurance than you would on replacing your phone.

- If you do need it, first check to see if you’re already covered by your bank or home contents insurance.

- If you’re not covered, stand-alone insurance can often be a great starting point, usually offering low prices and the most comprehensive coverage. Another good alternative is coverage from your mobile provider.

- Finally, always shop around and read the fine print — there’s a lot more to insurance than money in, money out — check to make sure that the excesses are reasonable and everything you need is covered.

What Do You Think?

I hope this was a useful article. If you’ve found a particularly good deal or would like share your experiences with mobile insurance, please feel free to let us know!

- Reach us on our Facebook page at Love Your Mobile

- Talk to us on the Mobile Fun Twitter

- Reach me personally on Google Plus

- Leave a comment in the box below

Thanks Jamie, that’s a good addition to the article.

That’s a great round-up. There’s also the option of retailer insurance.

Most online retailers like Buymobilephones.net offer insurance when you buy a phone on contract.

Some retailers make it compulsory for you to take it out, whilst others have it as a pre-included option that you can remove if you wish. You will generally get the first month free, however some retailers provide the first 3 months for free.

The cover they provide is very similar, covering you for theft, accidental damage and mechanical breakdown. The key areas in which the policies differ is the monthly cost – ranging from £5.99 to £9.99 – and the excess which can be £25 to £75.

Finally, if you have taken out insurance there’s two key things to remember.

Take note of your phone’s IMEI number (which can be found through the software, written on the box, or on a label inside the back cover) – you will need if you want to make a claim.

And if you are unfortunate to have your phone stolen, report it to the police and your mobile phone network immediately. You will need a crime number to make your claim and, if your insurance covers you for unauthorised calls, it will be invalid unless you have informed the network and had your phone barred.